28+ Mortgage lump sum calculator

A person with a certificate from a qualified accountant certifying they have a prescribed net asset or gross income level. Need help financing a new home or refinancing your current property.

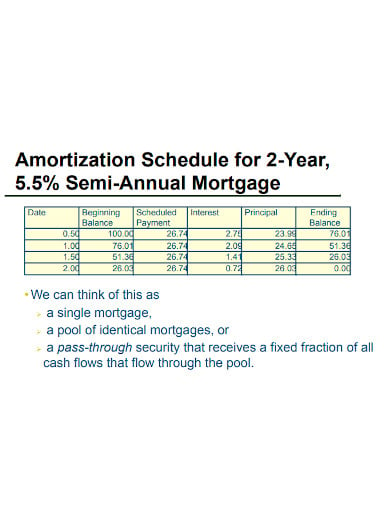

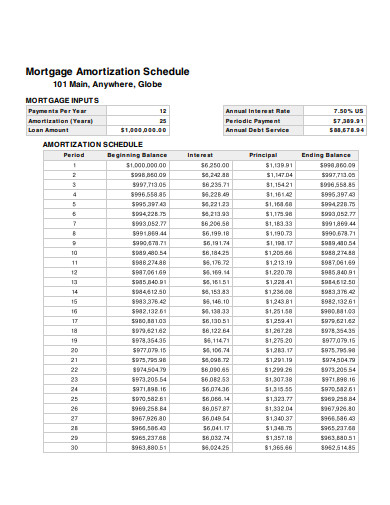

Tables To Calculate Loan Amortization Schedule Free Business Templates

You can make a lump sum overpayment by also logging in to Manage Your Mortgage.

. The average FHA 203b loan was a tenth of a percent higher at 328. Lets say 5 month time frame I can borrow 5000 for flat fee of 250 which would be paid back to lender 1000 a month for 5 months plus 250. This type of loan turns your homes equity into a lump sum of cash.

This might involve a substantial lump sum payment which could push you over the savings limits for means tested benefits including. Most closed mortgage products allow a once-per-year lump sum payment of up to 20 of the remaining principal amount or balance. If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original principal.

Just select My payments and services from the main menu. Our mortgage calculator helps you estimate your monthly mortgage payments. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

1 Your loan terms including APR may differ based on amount term length and your credit profile. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. You may qualify for a larger mortgage amount based on other sources of income such as rental income.

Enter how much you want to borrow under Loan amount. Excellent credit is required to qualify for lowest rates. Use our extra and lump sum repayment calculator to see how making extra repayments can.

Actual mortgage rates may fluctuate and are subject to change at any time without notice. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. As of July 2022 I should have 1000 per month to go toward my mortgage principal.

According to the Mortgage Bankers Association on November 6th 2020 the 30-year fixed rate mortgage had an average price of 298. This gives them an exemption under the Corporations Act 2001. A mortgage is a debt instrument secured by the collateral of specified real estate property that the borrower is obliged to pay back with a predetermined set of payments.

You can make extra payments regularly or a lump-sum payment toward the mortgage principal to reach that 20 sooner. Mortgage Early Payoff Calculator excel to calculate early mortgage payoff and total interest savings by paying off your mortgage early. Our free mortgage calculator gives you an idea of how much you can expect to pay for a mortgage in 2022.

Type in your mortgage term in years. The mortgage early payoff calculator will show you an amortization schedule with the new additional mortgage payment. This lump sum is usually provided to the person as a 5 percent allowance for the total loan.

Years Principal Interest Balance. Year Beginning balance Monthly payment. Underneath the sub menu My payments choose the make a payment Overpayment missed mortgage payment or manual mortgage payment option and select lump sum overpayment.

Before offers are made. Get in touch with an Edina Realty Mortgage specialist. FHA loans can work for you.

What Are Current Mortgage Rates. 30-Year Fixed Mortgage Principal Loan Amount. All first mortgage products are provided by Prosperity Home Mortgage LLC.

Mortgage prepayments may be subject to a prepayment charge. For mortgage approval you will typically need at least 5 of the purchase price as a down payment. If your balance at the end of the year is 100000 the maximum lump sum payment for that year would be 20000.

Current rate range is 549 to 1599 APR. Use Mortgage Repayment Calculator to calculate monthly extra payments amount of interest paid also with offset account on your home loan or mortgage. Loans lines of credit and credit cards are subject to credit approval.

Sutton is the second quickest moving market with homes being on the market for an average of 28 days before an. How to use this mortgage repayment calculator. Would it be smarter to pay the 5000 lump sum on my mortgage principal or pay the 1000 a month on it.

If your benefits have been underpaid you could be entitled to a back payment from the Department of Work and Pensions DWP. Backdated lump sum payments from DWP. A Capped Rate Mortgage is also another popular mortgage type.

The average 30-year fixed mortgage rate rose from around 3 in December 2021 to 589 currently according to Freddie Mac. That means they can buy financial products without a regulated disclosure document such as a prospectus or product disclosure statement. Or fortnightly or weekly minimum amount.

The following chart shows how much you can save based on a one-time lump-sum payment of 60000. The payment is applied during the third year of the loan. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments.

Which establishes that your housing expenses and total debt should not be more than 28 and 36 of your total pre-tax. The home loan calculator accounts for mortgage rates loan term down payment more. Find a mortgage expert in your area.

Need a mortgage with less stringent credit requirements and affordable down payments. Dba Edina Realty Mortgage. Many financial advisors have suggested adhering to the 2836 rule which says to not spend more than 28 of your gross monthly income on housing expenses and only 36 of your income.

Tables To Calculate Loan Amortization Schedule Free Business Templates

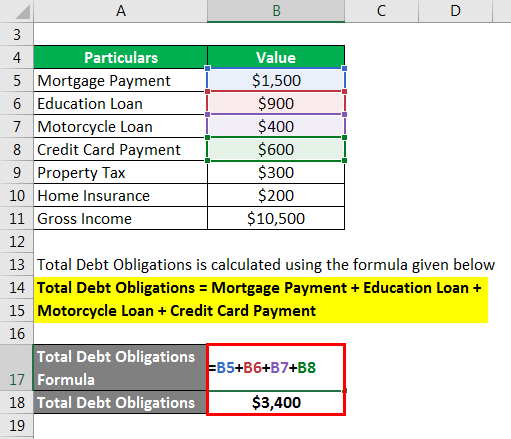

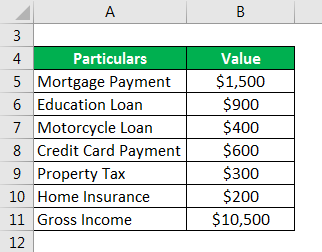

Total Debt Service Ratio Explanation And Examples With Excel Template

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Total Debt Service Ratio Explanation And Examples With Excel Template

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

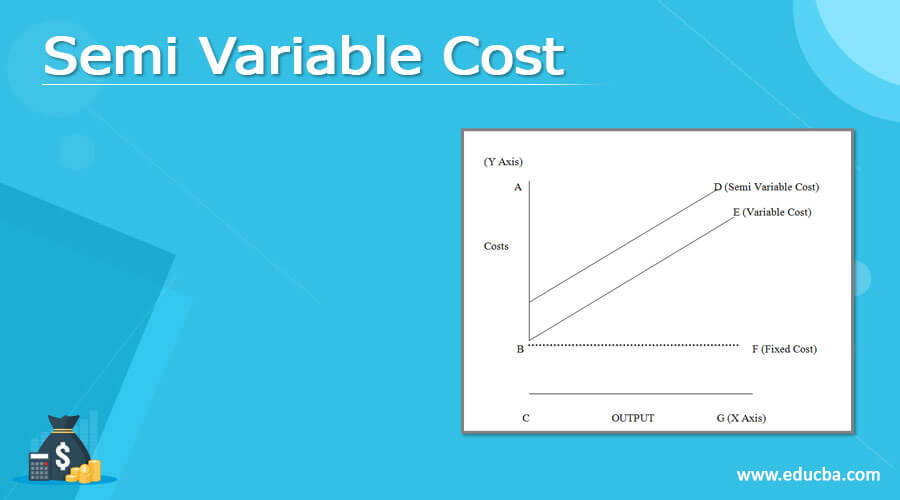

Semi Variable Cost Examples And Graph Of Semi Variable Cost

Discharge Of Mortgage Certificate Template Free Fillable Pdf Forms

Download A Free Home Mortgage Calculator For Excel Analyze A Fixed Or Variable Rate Mortgage And Inclu Mortgage Loans Financial Calculators Refinance Mortgage

Total Debt Service Ratio Explanation And Examples With Excel Template

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates